NIH Should Buy 23andMe

First published: November 24, 2024

Last updated: November 27, 2024

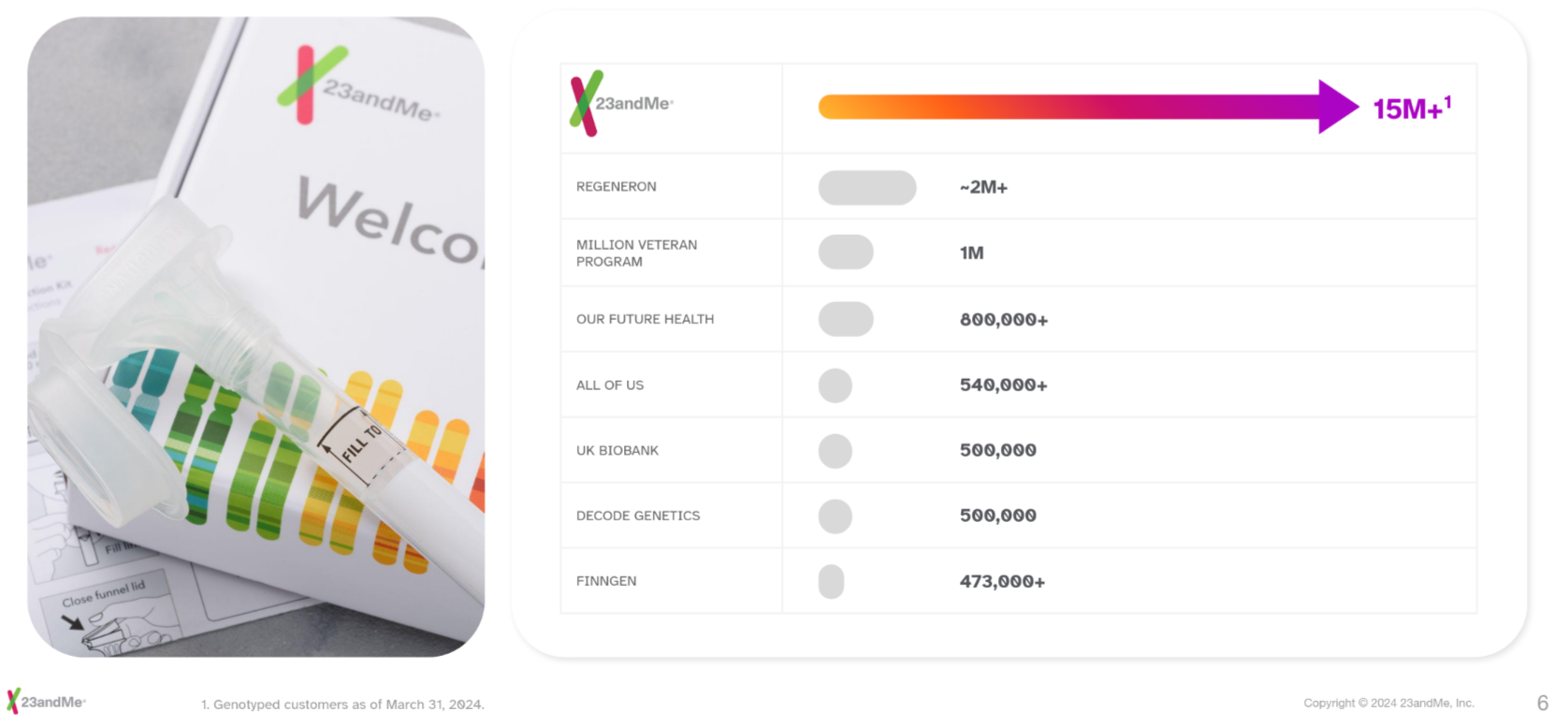

23andMe is a remarkable company. Founded in 2006, they pioneered direct-to-consumer genetic testing and have since genotyped DNA from over 15 million individuals, making it the “world’s largest crowdsourced platform for genetic research”1.

Importantly, over 80% of 23andMe customers have consented to the use of their data for research, creating a unique and invaluable resource for genetic and health studies.

The Unmatched Scale of 23andMe’s Data ¶

The size of 23andMe’s collection is hard to appreciate without looking at other large initiatives such as NIH’s All of Us program, or the UK BioBank. 23andMe’s investor relations documents highlight the fact that its collection of genotyped individuals is several orders of magnitude larger than its closest competitor.

Of course, 23andMe’s data is less comprehensive than other programs mentioned here. For example, All of Us includes whole genome sequencing and other complementary biospecimens and patient history data2. However, with an 80% research consent rate3, 23andMe data has already seen extensive use for both private and public research projects in a variety of scientific disciplines. Additionally, the ability to re-contact participants for follow-up studies, new sample collection, or trial recruitment adds further value to the dataset, fostering novel research opportunities and expanding its utility over time4.

Commercial Potential & Value

Exclusive licensing agreements with large pharma companies like GlaxoSmithKline were worth hundreds of millions upfront, with recurring revenue of $20-30 million per year. 23andMe is moving towards providing non-exclusive access to the research database, which could yield similar revenue from multiple companies, simply for access to the data. As the use of AI for drug discovery increases, so does the need for quality, curated data, further increasing the potential commercial and scientific value.

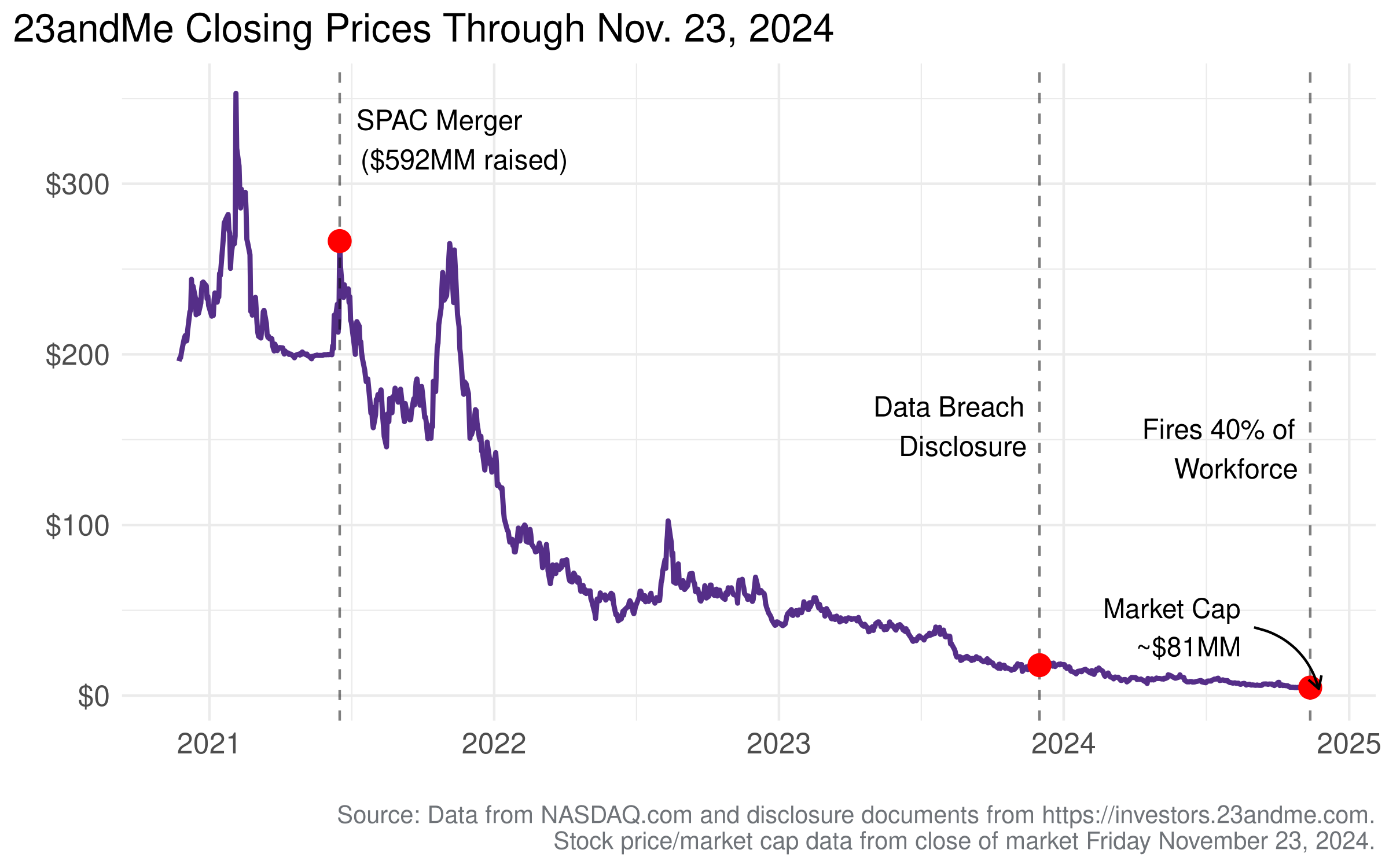

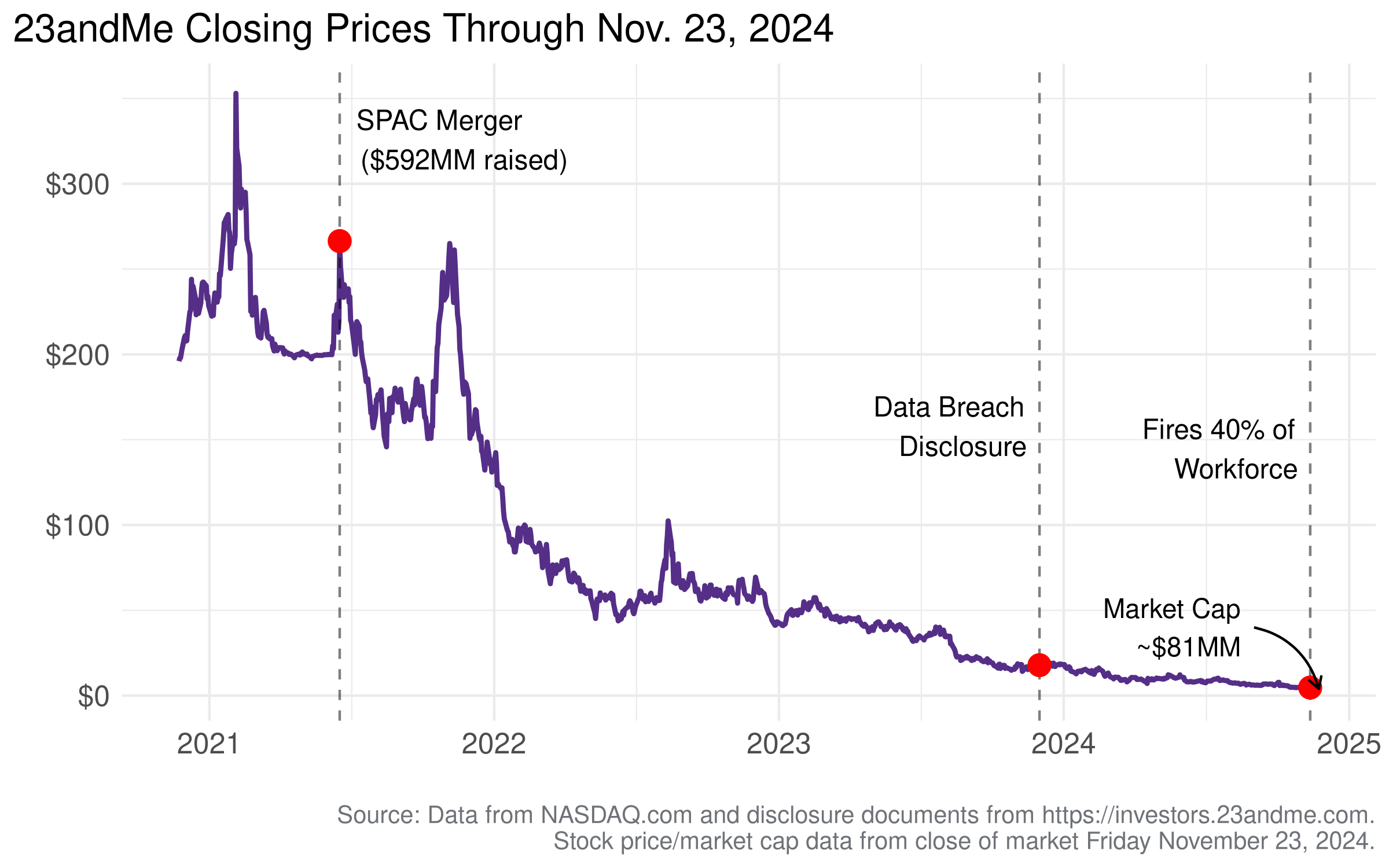

A Company in Crisis ¶

Despite the scientific and commercial value of 23andMe’s data, the company is in crisis. The special purpose acquisition company (SPAC) merger in 2021 valued 23andMe at $6 billion, but as of market close on Friday November 23, 2024, the market cap has fallen to ~ $81 million. In the face of the inability to commercialize and the numerous other challenges, CEO and cofounder Anne Wojcicki has worked to take the company private. Her most recent proposal led to the en masse resignation of the independent board members5. Along with a disastrous data breach and settlement, recent layoffs affecting 40% of the company, and narrowly avoiding delisting from NASDAQ earlier this year6, things are not looking good for 23andMe.

What happens if 23andMe fails or goes private?

Any go-private deal will likely involve big pharma, health insurance providers, or private equity. In any case, the data will likely be lost to corporate AI initiatives and we won’t hear about it again until the next data breach or senate hearings on the business practices of private equity and healthcare.

NIH Should Take the Lead ¶

I’d like to highlight an alternative. A rescue where everyone wins, and 23andMe’s customers don’t have to worry about who wants to buy their genotyped DNA.

The National Institutes of Health (NIH) is an ideal buyer and steward for the 15 million genotyped DNA samples 23andMe has accumulated. The NIH acquiring 23andMe—or a controlling stake in it—would ensure this invaluable public health resource is kept safe and preserved and leveraged for scientific discovery that benefits the world.

Mission Alignment

NIH’s mission is to seek fundamental knowledge about the nature and behavior of living systems and the application of that knowledge to enhance health, lengthen life, and reduce illness and disability.

- NIH Mission

This mission includes the specific goals of “develop, maintain, and renew scientific human and physical resources that will ensure the Nation’s capability to prevent disease” and to “expand the knowledge base in medical and associated sciences in order to enhance the Nation’s economic well-being and ensure a continued high return on the public investment in research”.

NIH has a responsibility to expand the knowledge base of US medical science. All of Us is one embodiment of this mission, focused on gathering a diverse set of genetic, environmental, and other biospecimen data to enable precision medicine. The goals and scope of the All of Us program is more ambitious than 23andMe7, but the addition of 15 million genotypes and associated technology would provide a massive new resource to complement its goals and advance the core mission of the NIH. With the market cap of 23andMe being less than a fifth of the 2023 budget of All of Us8, it would also be a bargain. Talk about government efficiency!

Public Data Stewardship

What happens to your data if 23andMe goes private? Don’t ask 23andMe. As a publicly funded entity, NIH is publicly accountable. The ‘shareholders’ are the American taxpayers, and the NIH is governed by policies enacted by elected representatives and appointees. That removes the influence of private incentives that push companies to cut costs and generate profits at the expense of public health, data security, and research.

The NIH has a mandate to focus on their mission, and this mission is more than simply marketing.

Strategic Benefit

Public data has a proven track record of accelerating discovery, enabling both public institutions and private companies to innovate and share findings. Consider AlphaFold, the deep learning model that accurately predicts protein structures—a breakthrough that transformed structural biology. AlphaFold’s success hinged on the Protein Data Bank (PDB), a massive, publicly available database of annotated 3D protein structures contributed by scientists worldwide9.

Despite the hype surrounding large language models in drug discovery, AlphaFold stands out as one of the few AI tools with a clear and compelling use case in the biopharma industry10. This tool was created by a private entity (Google’s Deep Mind) but would not have been possible without the public resource PDB. The lesson here is clear: accessible, well-curated datasets create the foundation for groundbreaking innovation.

The potential for precision medicine discoveries within 23 & Me’s genetic data is enormous, but we don’t yet know the full extent of what is possible. By offering supervised access to academic researchers and licensing data strategically to for-profit enterprises, NIH could unlock these discoveries while ensuring ethical use and public benefit.

A Rare Opportunity to Supercharge U.S. Scientific Resources ¶

Acquiring 23 & Me offers the NIH a once-in-a-generation opportunity to harness the world’s largest scientific datasets. For a modest investment relative to NIH’s annual budget, the agency could supercharge its precision medicine initiatives, protect consumers from data exploitation, and advance public health research on an unprecedented scale.

This acquisition would not only safeguard a critical scientific resource from privatization but also position the U.S. as a global leader in genetic research and personalized medicine.

Is it possible? What mechanisms would we use to execute a purchase? More on that soon.

Let me know what you think of this piece!

See 23andMe investor documents https://investors.23andme.com/static-files/c5b02f5f-eb63-40ea-bd02-0f44f0074fc5 ↩︎

See the All of Us protocol https://allofus.nih.gov/sites/default/files/All_of_Us_Protocol_Overview_Mar_2022.pdf ↩︎

Slide 24 https://investors.23andme.com/static-files/c5b02f5f-eb63-40ea-bd02-0f44f0074fc5 ↩︎

Section 2 starting on slide 23 https://investors.23andme.com/static-files/c5b02f5f-eb63-40ea-bd02-0f44f0074fc5 ↩︎

23andMe Board resignation letter https://investors.23andme.com/news-releases/news-release-details/independent-directors-23andme-resign-board ↩︎

Rule 5500(a)(2) requires a minimum closing share price of $4. 23andMe has bounced in and out of compliance with the closing price rule for the past few months. The new board members brought them back into compliance with 5605(a)(2) after the previous independent board resignation. ↩︎

https://allofus.nih.gov/sites/default/files/All_of_Us_Protocol_Overview_Mar_2022.pdf ↩︎

All of Us received ~$540MM in funding in 2023 and $357MM in 2024. https://allofus.nih.gov/news-events/announcements/all-us-ceo-keeping-our-momentum-amidst-funding-uncertainties. See NASDAQ from November 2024 for the market cap of $ME. ↩︎

See AlphaFold’s acknowledgements https://pmc.ncbi.nlm.nih.gov/articles/PMC8728224/#ACK1, and for more on PDB: https://pubmed.ncbi.nlm.nih.gov/33950382/ ↩︎

But the true utility still remains to be demonstrated as of November 2024 https://www.embopress.org/doi/full/10.15252/msb.202211081 ↩︎